The limitation shown on the last line of the Line 3 Limitation Chart and Worksheet (in these instructions), or

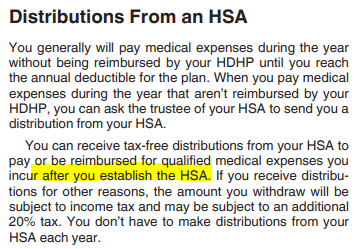

Payroll contributions through a salary reduction agreement elected by an employee (a cafeteria plan) are treated as employer contributions and are not included on line 2. Also, do not include any qualified HSA funding distributions (see line 10). Thus, you may contribute to your 2022 HSA through April 18, 2023, or a later date if you served in a designated combat zone or contingency operation.ĭo not include employer contributions (see line 9) or amounts rolled over from another HSA or Archer MSA. Armed Forces in a designated combat zone or contingency operation, you may be able to file later. If you were serving in, or in support of, the U.S. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia-even if you don't live in the District of Columbia. However, for the 2022 income tax return, you may file Form 1040 or 1040-SR by April 18, 2023. Normally, that's the April 15 after the close of the tax year. Also, include amounts contributed for 2022 made in 2023 by the unextended deadline for filing your 2022 federal income tax return. Include on line 2 only those amounts you, or others on your behalf, contributed to your HSA for 2022. You cannot treat insurance premiums as qualified medical expenses unless the premiums are for: If, under the last-month rule, you are considered to be an eligible individual for the entire year for determining the contribution amount, only those expenses incurred after you actually establish your HSA are qualified medical expenses. The cost of home testing for COVID-19 for you, your spouse, or your dependent(s) is an eligible medical expense for tax purposes, which may be paid or reimbursed from an HSA.Įxpenses incurred before you establish your HSA are not qualified medical expenses. The cost of menstrual care products (tampons, pads, liners, cups, sponges, or other similar products) are also reimbursable for HSA purposes.Īmounts you pay for personal protective equipment, such as masks, hand sanitizer, and sanitizing wipes for you, your spouse, and your dependent(s) for the primary purpose of preventing the spread of COVID-19 are treated as medical expenses eligible to be reimbursed from an HSA. Even though nonprescription medicines (other than insulin) do not qualify for the medical and dental expenses deduction, they do qualify as expenses for HSA purposes. As the HSA account beneficiary, you can pay these expenses for medical care for yourself, your spouse, and your dependents. See the Instructions for Schedule A and Pub. Generally, “qualified medical expenses” for HSA purposes are unreimbursed medical expenses that could otherwise be deducted on Schedule A (Form 1040).

0 kommentar(er)

0 kommentar(er)